Are you looking for a more secure foundation for your financial future? Whole life insurance could be the solution you’ve been looking for. Today’s guest is Sarry Ibrahim, founder of Financial Asset Protection, a financial services firm that focuses on one sole concept; the Bank On Yourself concept, also known as the Infinite Banking Concept. He also hosts their official podcast, Thinking Like a Bank. Sarry helps real estate investors, business owners, and full-time employees grow safe and predictable wealth regardless of market conditions. How? Through whole life insurance. Tune in as he joins Dr. Gary Sanchez to break down the concept using his gift, the WHY of Simplify.

—

Watch the episode here

Listen to the podcast here:

Ensure Your Financial Future With Whole Life Insurance With Sarry Ibrahim

If you’re a regular reader, you know that every episode we talk about 1 of the 9 Whys and then bring on somebody with that Why so you can see how their Why has played out in their life. We’re going to be talking about the Why of Simplify, which is a very rare Why. If this is your Why then you are one of the fabulous people that make everyone else’s life better. You have the unique gift of reducing the number of steps required for almost any task. If most of us believe that a procedure requires 8 sequential actions, you see how to do it in 6.

You constantly look for ways of simplifying from recipes to business systems and how you organize your garage. You feel successful when you eliminate complexity and remove unnecessary elements in a process. You streamline things for the benefit of all and break things down into their simplest form. You like things direct to the point and don’t give me the fluff. I’ve got a great guest for you. His name is Sarry Ibrahim. He is a financial planner and member of the Bank On Yourself organization.

He helps real estate investors, business owners and full-time employees grow safe and predictable wealth regardless of market conditions using a financial strategy that has been around for over 160 years. Sarry started his journey when he was in grad school completing his MBA. He worked for companies like Allstate, Blue Cross, Blue Shield, Cigna, HealthSpring and Humana before founding Financial Asset Protection, a financial services firm that focuses on one sole concept, the Bank On Yourself concept, also known as the Infinite Banking Concept. Sarry, welcome to the show.

Gary, thank you so much for having me on. I appreciate it.

This is going to be interesting. We’re going to dive back into your life. You told me already you’re in Chicago. It’s a little bit chilly there. You grew up there. Tell us about that. Where did you grow up in Chicago? What were you like in high school? What would your friends say about you?

I grew up in a Southwest suburb of Chicago. It’s Palos Hills for those familiar with the Chicago area. It’s about 30 minutes or 40 minutes South of Downtown Chicago. I was always very curious growing up. I always wanted to learn more about how the world worked more than I could handle and beyond my scope. For example, in class, I would look out the window and think about how things work outside of the classroom rather than inside the classroom. I was always a visionary.

I learned that visionaries think far ahead of steps. That could be problematic because if you’re not focused on the moment, you can miss certain things. That was also part of my life. I would make mistakes because I wasn’t present. I was thinking way too far ahead but I still enjoyed imagining different things that I still do as an entrepreneur. One of the reasons why I’m an entrepreneur is because I can’t settle for normal day-to-day things. I have to always think far ahead.

When I was a senior in high school, I took a class called Consumer Economics. It was how to write a check, how to look at a bank statement, what is a mortgage, what is interest and all these things. I liked it a lot. I understood those things back then. I wanted to make that into a career where that’s what you do for a living. You help people with financial things like that. I was still new to it. I was still young.

I didn’t know that was called financial consultant or financial planner. I got a bachelor’s degree, went to college and got an MBA with a concentration in project management. I started working for the insurance companies and seeing how they would think and evaluated risks. That led me into financial planning and helping people with financial strategies and accomplishing financial goals.

[bctt tweet=”You’ll never know your passion before you actually do something. How are you going to be passionate about a career that you’ve never done before?” username=”whyinstitute”]

I’m thankful that it was exactly what I’ve always wanted to do. It’s to solve financial problems. It’s not so much of, “If you have money, you can work with me.” It’s more of, “What is it? What’s going on in your life? What are some of your financial problems? Either too little money too much money or whatever the case is, what do you need help with?” That’s what I do. I help clients in all 50 states accomplish their financial goals. That’s who I am and some of my background.

What made you go into insurance? How did you get from college into working for different insurance companies? It sounds like you worked for a couple of them as well.

Typically, the average person who works for an insurance organization is 59 years old. It’s usually an old-school industry to be in. It’s not so much with my friends. I was the only one in my social group that went into insurance. I don’t know what it was. I came across an opportunity to work at Allstate. That was the first company. I told myself, “I don’t know what to expect. I have no idea what’s on the other side of that door until I go through that door and see.” That’s what happened. It was a lesson in life. You will never know your passion before you do something.

It’s almost impossible to say, “I’m going to do this career because I like it,” when you haven’t even done that career yet. That’s how high school and college are trained. It’s like, “Choose something you’re passionate about. Stick to it.” How are you going to be passionate about a career that you’ve never done before? The same is true that I would have never chosen insurance or financial services. It doesn’t sound transparent and appealing but once I got involved in it and understood it, I liked it. It made sense. There was a lot of logic behind it. Speaking of simplifying things, there were a lot of things that you could simplify in that world.

You got your MBA. You’re done. There are many directions you could have gone. Why Allstate?

First of all, I liked the name, the brand and how it was marketed. I worked there. While I was working there, I found that a lot of clients also liked working with the brand. More importantly, they liked working with people. One of the selling points of working in insurance is working with people, not just the companies or the brands. I enjoyed working with people and then owning the process of dealing with problems, claims and things like that. It was also a self-employable field to be in. That means that you could branch off and start your business either with Allstate or other companies.

I then went from Allstate to being an independent consultant/broker so I could represent different companies. That was something attractive to me. I thought about it. I was like, “How would the future look? The future could be that I have contracts with 30 different insurance companies and financial organizations. I have thousands of clients. I can work anywhere in the world. I just need a computer and a phone.” That was the kind of industry it is.

If I was, for example, working as a mechanical engineer for a Fortune 500 company, that’s not a self-employable field. I can’t branch off, start my mechanical engineering company and do that. With insurance, you could. You have that opportunity. It’s people-to-people and small business-to-small business. It was the lifestyle that got me attracted to it. I work entirely from home. Everything is done on Zoom or over the phone. All my podcasting as a guest and as a host is done on Zoom. My wife and I have a son. We could travel and go somewhere. I’m not restricted to 9:00 to 5:00 anywhere.

It seemed like there were not too many steps to get you to where you wanted to go.

It’s hard work still. I had to build up the book of business. The independent insurance route has about a 95% turnover rate. For every 100 people, 95 quit and go do something else because it’s very difficult. It’s hard to attract people, work with people and keep them as clients. I positioned more into financial planning, not just insurance. Insurance is one of the tools that we have. There’s also the financial planning aspect of building out financial plans for people, saving for retirement, getting out of debt, negotiating and things like that. We do more of that too.

You got into insurance, transitioned over to financial planning, got out and started your own. You used a 160-year-old process. Tell us about that.

It’s called the Infinite Banking Concept. It was invented by Nelson Nash years ago. One of the primary routes of the Infinite Banking Concept is the use of cash value whole life insurance. For how not sexy it sounds, it’s one of the most significant things in the world. These insurance companies have been in business for over 160 years. They have been implementing these. It’s the same with companies. A lot of organizations that have been around for a long time, their backbones or reserves are in cash value life insurance. Banks have most of their reserves in cash value life insurance.

A lot of the things that happen in the world, financially speaking, revolve around life insurance companies. There are about 2,000 life insurance companies in the United States alone. If you were to take all their reserves and money and pool it together, it would be greater than all of the cash from all the banks and oil companies in the world combined. It gives you a visual of what’s happening. If a high-rise building in Switzerland is being built, a US life insurance company probably has something to do with it. They have loaned money to it and invested in that deal. A lot of things in the world are happening from the backbones of life insurance companies.

Should that make me feel good or bad?

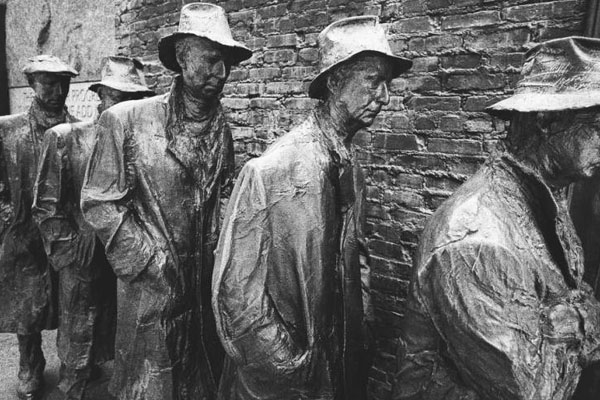

That should make you feel good because there’s certainty and security. The people, families and corporations that made it to the Great Depression were ones who had reserves and life insurance because the way that insurance companies operate is not directly correlated or affected by the stock market and other things. In March 2020 when COVID first happened, life insurance companies’ cash reserves weren’t affected by COVID whereas the stock market was. The stock market went up since COVID happened. Initially, there was a hit to it.

From the perspective of certainty and safety, you want your money sitting somewhere or at least one place. If everything goes down and shuts down, you have one account somewhere that’s protected. It’s going to earn compound interest and growth. This is exactly what we do. We use the Infinite Banking Concept to help clients, small business owners and individuals have at least some certainty for the future and something they could predict and look onto.

We have a podcast called Thinking Like a Bank. We launched Episode 51. Check out Episode 51. We talk about what happens when there’s chaos. There’s this Ukraine-Russia situation. How does that impact us? We don’t know. Nobody knows how long that war is going to last and the magnitude of it. As business owners and individuals here, we need some certainty of how do we take our cash with us into the future, grow it into the future and no risk at all.

What is a cash value whole life insurance?

[bctt tweet=”We use the infinite banking concept to help clients, small business owners, individuals have at least some sort of certainty for the future. Something they could predict and look onto.” username=”whyinstitute”]

There are typically three types of life insurance out there. There’s a term, whole life and universal. The term has a set period. It’s usually 10 years, 20 years or 30 years. There is no cash value to it. It’s simple life insurance only. Use it for that certain period. There’s a start date and end date. The whole life has a start date. It’s life insurance. There’s also a savings account portion to it that grows and earns interest and dividends. Dividends are not guaranteed but there are dividends involved with whole life insurance. The cash value grows over time.

Universal life is very similar to both the term and whole life. It’s a little bit complicated to explain but it’s pretty much another form of permanent cash value life insurance. We’re focused on the middle one or cash value whole life insurance. It’s a special design. It’s not just from any company or agent but a special design cash value whole life insurance policy that allows you to build up cash in it to protect from market conditions. There are a ton of tax advantages with whole life insurance to give you the ability to always have access to that money.

Here’s one problem in 2008. For the real estate investors reading this, you know what happened in 2008. A lot of people had properties. A lot of real estate investors, contractors and construction companies had money in real estate. A couple of compounding problems happened. One problem that happened was the real estate market crashed. All the values dropped significantly. After that happened, banks stopped loaning out money because the collateral went down. It became too risky.

Plus, unemployment went up. A lot of companies shut down. The stock market took a hit. That means that it wasn’t a lendable society. A lot of people weren’t lendable anymore. That changed the way banks started lending money. What happened if you owned twenty real estate properties that were all paid off? You’re stuck because you don’t want to sell them at such a low rate if you might have to. You can’t borrow against them because there’s no bank available to loan you the money.

Even if there was a bank to loan you the money, they’re going to loan you an amount that’s much less than that because the values went down and banks loan according to the value of it. It had this spiraling effect like, “If this then that,” all spiraling together. With whole life insurance, that won’t happen because it’s not correlated with the stock market. When the stock market or the real estate market goes down, the account values don’t go down.

That’s one aspect of it. You always have the value of it increasing no matter what happens in the market. The other side to it is you have guaranteed access to the funding or the money either through loans or withdrawals regardless of how the economy does. It’s not based on credit nor is it based on economical or financial external conditions. Banks loan out money according to the person’s credit, the economy and the community we’re in.

How does your money grow in a whole life plan?

Let’s say, for example, one of the companies we work with is Lafayette Insurance Company. Lafayette Insurance Company is a private for-profit life insurance company. They have investments. They invest in the bond market, give out loans to banks, invest in real estate properties and earn profits from every year. Part of their profits every year get distributed back to the policy owners because it’s a mutually-owned life insurance company and because how they have structured their policies is to give dividends back to the policy owners. That’s one way. The second way is they guarantee you an interest rate.

It’s a very small interest rate. It’s nothing crazy. It was 4% up until 2022. Some regulations changed. They dropped down to 3% guaranteed gross. There are also the dividends. We’re expecting the dividends are going to go up because dividends are positively correlated with interest rates. As interest rates go up, it’s projected that dividend rates will go up as well. That’s how somebody could have a cash value whole life insurance policy and have the cash in it grow over time, not just from the money they’re putting into it but also from the insurance company growing and then providing dividends and interest back to the accounts.

Let’s say you took $100 and put it into a whole life plan. You took $100 and put it into the stock market or the S&P 500. What happens? Take us through the scenarios.

A lot of people will project that. They will project, “What if I put $100 a month into a whole life policy versus the S&P 500 fund?” Number one is that the whole life policy is not meant to be an investment. It’s meant to be a savings account. It’s meant to be used for investments. What you could do is fund the whole life policy, borrow against that and then put it in the stock market, which a lot of people do. A lot of our clients do it. We help them structure things like that. It’s a matter of both and it’s not meant to replace either one.

There are so many different ways to give financial advice and so many rules to follow. One thing I would recommend is the whole life part is just one of the legs in your financial portfolio. It’s not the whole financial portfolio. It shouldn’t be either whole life insurance or the stock market. I believe that people should be truly diversified. They should have some money in the stock market, whole life insurance, real estate, their business and different places. I use the word truly diversified. We talked about this in Episode 51 of our show.

Some people might have money in the stock market in low risk, medium risk and aggressive. They might say that they’re diversified but all their money is in the stock market. That’s not truly diversified. Truly diversified is some money in the stock market, bonds, different markets, different areas and even places that are not correlated or connected to each other. It’s an example of whole life insurance. If the stock market goes down, whole life insurance is still there. If the real estate market goes down, you want some foundations in your financial plan.

If you put $100 into a whole life, you would get a 3% return. If you put it in the stock market, you could get a 20% return or a 20% loss. It’s not much of a gamble but it’s not much of a return.

Nobody gets rich off of whole life insurance. It’s meant to preserve capital. It’s meant to keep your wealth and have it outpace inflation and a savings account because savings accounts nowadays give 1/10 of 1% if you don’t have a percentage. At least with the whole life policy, you can at least outpace that. Plus, you get the tax advantages and you have it sitting somewhere that’s not going to be impacted by market conditions. Plus, there are no credit qualifications for the loan when you borrow against it.

Plus, there are some legal things too with litigation. In most states, it’s protected from predators and people trying to sue you. There are a lot of aspects other than the rate of return that people should consider. You mentioned a good point on the rate of return aspect. A lot of people come in and say, “What’s the rate of return on it?” We tell them, “It’s 3%.” They say, “No, thank you.” They go somewhere else and potentially earn 12% or 10% in the stock market.

I see what they’re thinking. They’re thinking they want the most value out of their money but there are still other aspects like the taxes, protection, economical conditions and other things that go into play other than the rate of return. Plus, you could use the policy for higher rates of return. We have clients who fund whole life policies. From the funds in the policy, they borrow against those and then do private money lending where they’re investing to real estate investors.

It inflates your overall return when you have a whole life with other lending and investments because what happens is you get both. You get the growth from whole life insurance and the private money you’re lending out or the other investments you have. Those together give you a much higher rate of return when it’s together rather than using one or the other. When you integrate them together, it gives you a compounding or a much higher return than choosing one without the other.

[bctt tweet=”One rule of financial planning is it’s never one solution for everybody. There are different situations.” username=”whyinstitute”]

Is it an interest-free loan that you give yourself?

You would borrow the money from the insurance company and pay interest to the insurance company. It’s typically a simple interest rate that’s compounded in arrears. At the end of the year, the interest is due and it doesn’t compound on it. When you earn on your policy, you’re earning compound interest. What happens is that there’s arbitrage. Arbitrage is the growth of your money even when you’re using the money. A lot of real estate investors do this.

They will borrow, for example, $100,000 from their policy and then use it for real estate. Let’s say they paid $5,000 back to their policy. They may have earned that year $10,000 from their policy. There was an arbitrage or a net gain of $5,000. They bought money at $105,000 and earned $110,000. Their split is $5,000 in that situation. There is a lot more that goes into it but it gets to the point where the money outpaces, which brings it into a whole other topic of opportunity costs. Imagine if you paid cash for everything, bought real estate or cars with cash and invested in your business with only cash.

The downside to that is you would never earn interest on your money. You would lose the opportunity cost you could have earned on that interest. You spent that money. Had you invested that money or saved it somewhere, borrowed against it and then paid it back, you would never skip a beat on your interest. You would always keep earning interest even when you are buying real estate and cars, investing in your business or whatever else you’re doing.

Are there different times in your life when a whole life makes sense and times when it doesn’t make sense? Does it always make sense?

One rule of financial planning is there’s never one solution for everybody. There are different situations. This is why you need to work with somebody who’s unbiased and who’s going to take a step back and look at your financial situation. There are some times when whole life insurance doesn’t make sense for the people who, for example, don’t have much in reserves or income. In my opinion, it wouldn’t make sense to tie up that money into a life insurance policy because there’s a capitalization period. There’s a period where you’re funding the policy.

Your cash value is not going to match directly with your premiums going into it. There’s going to be a dip. When you start a business, you’re not going to be profitable in year one. There’s going to be a slight dip in your business. Maybe a couple of years later, you would come out profitable. It’s the same thing with whole life insurance. You might do a policy. For example, in year one, you put $10,000 and your cash value in year one is $6,000. There was a cost to that insurance but it’s not about year one. If somebody is only focused on year one then I would not recommend it to them.

If somebody is focused on the next 10 or 20 years, I would recommend it to them. Those are the costs. Eventually, the cash value exceeds the premiums paid to it. You end up coming out ahead. You get more out of the policy than you put into it in the later years, not in the first year. I don’t know of any investments without taking any risks when in year one, you could come out ahead. Maybe there are some bonds and things like that you could do where you could come out ahead but for the most part, it’s a long-term play when you passively invest.

What is your goal as a financial planner?

Whole Life Insurance: When you integrate them together, it gives you a compounding return, a much higher return than just choosing one without the other.

My goal is I want to help people solve their problems. That’s how I stay in business. How I can get satisfaction out of what I do is by solving problems for people. If somebody has debt that they want to pay off efficiently and they want to get out of debt, I can help them with that. If they want to save for retirement, I can figure that out. We can go through a solution for them. If they want to transition from a full-time employee to running a business and they need help with the financial aspects of that, we can help with that. That’s what I want. I want to be able to solve problems for people and concrete problems, not just sell a mutual fund and say that it’s the solution. It’s more concrete where the client says, “This helped me a lot. This helped me out this way.” They see the benefits of it.

Who has been your biggest mentor that has taught you the most? You’re competing out there in the marketplace with guys that are 60 and have been doing this for 30 years. Why should somebody choose you over somebody that has been in the field for 30 years?

Here’s full disclosure. Thankfully, I’ve been in a situation where it was me or another advisor who has been in the industry for 30 years. I’ve been thankfully chosen over them. There are a couple of things. Number one, I’m part of an awesome team. I’m part of the Bank On Yourself group. We’re a group of 300 advisors in North America. We have weekly training calls. We had to go through a credentialing program to get accepted and be able to provide these types of policies and solutions for clients.

That had a huge impact on my success. Number two, I have a mentor too. I’ve been working with them for years. His name is Mark Willis. You could check out his podcast called Not Your Average Financial Podcast. He has helped me out a lot. He’s a big reason for my success. He is the top Bank On Yourself professional out of 300 advisors in North America. He is number one since he started with this program. I have a lot of support from the top advisors in the country. I’m thankful for that.

I like to simplify things. I’ve worked with clients before who said they have read books, listened to podcasts and still haven’t figured out this concept. After twenty minutes on the phone with me, they did. Not to brag but that has been practiced on my end. I’ve been practicing the skill, not just this skill particularly but also the skill of conveying subjects and concepts to people and breaking them down into smaller and more manageable pieces. I’m very good at that.

I’m taking complex things and situations and then breaking them down to the point where somebody who is ten years old can understand exactly what’s going on. It’s like Albert Einstein’s quote, “If you can’t explain something in very simple terms then you don’t understand it properly.” I’m a big advocate of that. Thankfully, a lot of clients have seen that in me. They have been wanting to work with me because I don’t start the conversation by talking about bond rates, the S&P 500 and all these things that are irrelevant to them.

It’s not about the company, percentage or rate of return. It’s about working with individuals who can listen to you and implement things that truly matter to you. If a client says, “I want 10% on my money,” and then you say, “I’ll find something for 10% of your money,” that’s not an adequate solution. What is it about the 10% that you want to accomplish and going further into that? That’s the advantage that I have over people who have been in this industry for a long time.

Why is it important for you? What do you see as the benefit of simplifying things for people? Why is simplicity important?

People need to understand what’s going on. They need to understand, learn and remember what you’re saying and how things work. It’s a huge factor in how they live. The way you live has a lot to do with what you know about the world. That has a huge impact on the way you live. People need to understand those things. Plus, there’s a lot of chaos and confusion out there. A lot of people don’t know the details of things.

[bctt tweet=”It’s not about the percentage is not about the rate of return. It’s about working with individuals who can listen to you and who could implement things that truly matter to you.” username=”whyinstitute”]

If you could break it down, it’s very satisfying to take something hard or complex, break it down and then make it simple to understand. It creates momentum. In my shoes, it’s good to know that I can work with a client. They’re all over the place financially and we can solve a problem. It’s important. If you’re working with a professional, they need to make sure that they’re making things very simple for you and not making things more complex or confusing.

What did it feel like to you when you took the WHY Discovery, it came up with Simplify and you started to read about it? How did that feel for you?

I was surprised but not really. There were 10 or 20 questions. I was going through each one. When I got the result, I was like, “Is that who I am?” When I thought about it further after that, I was like, “That does make sense.” I’ve done many podcasts where we finished recording. For example, we will be talking about Infinite Banking like how we were talking about it and the host will say, “It makes a lot of sense. You broke it down. I remembered everything you said. It’s very clear.” It does align with making things simple. It is what I expected.

You have one of the rarest Whys. Simplify is one of the rarest. It’s fascinating to me because people with your Why get stuff done. They’re so efficient, results-oriented and super valuable to be around. What’s the difference to you in simplifying something simple versus something complex?

It gets stuff done for sure. When you simplify things, you see a clear side of it. One problem I used to have when I couldn’t get things done is because it was too complicated to do. You weren’t even going to do it anymore. When you break it down into simpler terms, you get more things done. That’s very important. It’s getting things done especially in entrepreneurship. You can get a lot of things done efficiently because there’s a lot of work in running a business.

You need to be able to get a lot of small little things done in a day. I don’t know why but time flies by as an entrepreneur because there are so many things that need to be done and broken down. This is something that I do. Not to brag but I’m very good at doing a lot of different things, keeping track of clients, business plans, retirement accounts and taking care of my immediate family, my parents and things like that. There’s a lot going on.

I have to be able to do a lot of things in a day. One thing I do is I have systems. I have everything on a calendar. Every morning, I go into the calendar and write out each task one by one. After I complete it, I highlight it. That way, I could see what’s done. It also creates momentum to get more things done. It’s a task as simple as sending an email to this person all the way to finalizing an analysis for a client.

It varies and there are different degrees. I typically put the easier ones on top. That way, I can go through them quicker. I’ve got pushback from this. Some people will say it’s better to put the harder ones on top like the saying, “Swallow the frog first.” Test out different things. It’s going to be different for you. Those are some of the things that have worked for me. I like making things simpler. Life is already complicated as it is.

It’s great for the readers to get to experience somebody that has the Why of Simplify because there’s only 4% of the population that has your Why. People with your Why are super valuable to have on a team. People that overcomplicate things are not as valuable to have on a team because they make it so complex that the only person that can do anything with it is them. If you were to start to build your messaging, marketing and branding, do you think it would be valuable for your clients to know that your Why is to Simplify?

It’s important because one thing that I do and I’ve seen success with through working with clients is that I constantly reiterate both of our Whys. It’s why I’m helping them and why they are implementing too. Along the line, it’s very easy for people to forget, “What are we doing here? Why are we having this financial?” That happens a lot. People need reassurance. It’s providing them the reassurance of what’s going on and why. I’ve noticed that when you start with Why like Simon Sinek’s Start With Why, it lays out the foundation for the following things.

I’ve noticed too that even subconsciously, I’ve chosen titles of videos and podcasts to listen to and watch based on the titles. Instead of me saying why I became a financial planner, it’s going to be more appealing than how I became a financial planner or what financial planners do. It’s the most powerful word in English or any language with the word why. It’s the reason why you do things. From a marketing perspective, it’s the most intriguing part of the marketing message.

It’s especially if you take it and apply it to, “Why should I choose you?” As a prospect, I’m sitting here and I meet you for the first time. What’s going through my mind is, “Why should I choose Sarry?” There are a lot of financial advisors right there. They’re everywhere just like anything. They’re trying to figure out why should they choose you. If you don’t tell them then they won’t know.

The better able you are to articulate why you do what you do and what it is you believe, the more you will be able to attract those people that believe what you believe. Your ideal client is somebody who wants it simple and easy to understand and doesn’t want all the fluff and the extra. They just want simple and easy-to-follow instructions on, “What do I need to do? I want to make sure it’s getting done. I want to know what’s going to get me the results that I want.”

There are people who think like you. You’re most likely to attract those people.

They believe what you believe. If you’re able to articulate it, say it and use it in your messaging, marketing, podcast and when you sit down with your prospect, it instantly cuts to the chase to why they should choose you. You sat down and said, “I believe that success happens when we make things simple and easy to understand, don’t overcomplicate it and go directly to the point. Let’s figure out what you want, how to get there and what you need to get there. That’s when we’re going to have success. That’s what you can get from me.”

“I’m not going to give you all the fluff, try to sell you stuff you don’t need and try to get you to buy whatever. It’s going to be simple and easy to understand.” We have a completely different conversation than, “I wonder what this guy is going to try to sell me. He’s going to throw me into insurance because he makes the most money or whatever the story is.” We create a narrative. It’s your ability to cut to the chase and tell me what it is you believe.

We didn’t get to do your How and What yet but I’m going to take a stab at what your How and What is based on our conversation. Your Why, which we already know is to make things simple and easy to understand. How you do that is by making sense of complex and challenging concepts. Do you feel more successful when you’re able to show somebody a path or when you’re able to help them in whatever way they need help?

It’s the path for sure.

[bctt tweet=”When you break it down into more simple terms, you get more things done.” username=”whyinstitute”]

Ultimately, what you bring is the right way to get predictable and consistent results. Your Why is to make things simple and easy to understand so that everybody can do it. How you go about doing that is by making sense of the complex challenges that they’re facing and solving their problems. Ultimately, what you bring is the right way to get consistent and predictable results. You bring them the path and the map to get where they want to go. How does that feel to you?

I feel like I know more about myself now from hearing those things.

Does that feel right though?

It does. I do agree that it does make sense. I noticed it too. I’m laying out the path and solution. It creates more reassurance for everybody, for myself and for other people that I work with. I’ve thought about it. For example, what if I were to be a consultant for a company or a sales organization? It’s very hard to predict sales because you never know what’s going on in the customer’s mind. You can’t control that but you can control things that lead up to that. It’s the number of times you reach out to somebody and the length of time you speak to people. There are predictable things that you could do that will give you the results you’re looking for.

I have one last question for you. What has been the best piece of advice you’ve ever gotten or the best piece of advice you’ve ever given?

The best piece of advice I’ve gotten was from my mentor, Mark Willis. He says, “Never take anything personally.” There are a lot of emotions out there in the world and a lot of people could take things. I do sometimes take things personally but having the ability to not take things personally will put you ahead, especially in an entrepreneurial mindset. Getting ahead is never taking anything personally. There are so many other things going on in the world and other people’s minds that for the majority of the time, it’s not intended for you or at you. It’s having that mindset of never taking anything personally.

If there are people reading and they want to get ahold of you, contact you, work with you or listen to your podcast, what’s the best way for them to get in touch with you?

If you’re looking to take a different approach financially and you have an open mind, you can go to ThinkingLikeABank.com. You can download a free eBook there, schedule an appointment with me and check out our podcast called Thinking Like a Bank. All that is from the website.

Sarry, thank you so much for being here. I enjoyed getting to know you and meeting another Simplify.

Me too. Thanks, Gary. Thanks for having me on.

—

Thank you so much for reading. If you have not yet discovered your Why, you can do so at WHYInstitute.com with the code Podcast50. If you love the show, please don’t forget to subscribe below and leave us a review and rating so that you can be part of bringing the Why and the WHY.os to the world. Thank you.

Important Links

- Bank On Yourself

- Financial Asset Protection

- Infinite Banking Concept

- Thinking Like a Bank

- Episode 51 – Thinking Like a Bank

- Not Your Average Financial Podcast

- WHY Discovery

- Start With Why

- ThinkingLikeABank.com

- WHYInstitute.com

- WHY.os

About Sarry Ibrahim

Sarry Ibrahim is financial planner and member of the Bank On Yourself Organization. He helps real estate investors, business owners, and full time employees grow safe and predictable wealth regardless of market conditions using a financial strategy that has been around for over 160 years. Sarry started this journey when he was in grad school completing his MBA. He worked for companies like Allstate, Blue Cross Blue Shield, Cigna Healthspring, and Humana before founding Financial Asset Protection, a financial services firm that focuses on one sole concept; the Bank On Yourself Concept, also known as the Infinite Banking Concept.

Sarry Ibrahim is financial planner and member of the Bank On Yourself Organization. He helps real estate investors, business owners, and full time employees grow safe and predictable wealth regardless of market conditions using a financial strategy that has been around for over 160 years. Sarry started this journey when he was in grad school completing his MBA. He worked for companies like Allstate, Blue Cross Blue Shield, Cigna Healthspring, and Humana before founding Financial Asset Protection, a financial services firm that focuses on one sole concept; the Bank On Yourself Concept, also known as the Infinite Banking Concept.